Hi everyone,

A couple months back, my friend had to get a Td vaccine to get some paperwork filled out. His university’s health center didn’t offer it, so we had to look elsewhere. The medical clinic filling out the paperwork recommended we go to the City of Lubbock Health Department, which is a community health center in Lubbock. The clinic personnel specifically instructed my friend to state that he did not have health insurance, even though he did, so that he would only be charged $15.00 for the Td vaccine.

I thought this was weird, but okay. We went to the City of Lubbock Health Department and told the employee at the front desk that my friend did not have health insurance. The department charged him $15.00 and we waited in the seating area.

While we were waiting, a young couple entered the building. The female was only 18 years old and the male was 19 years old. They both had to get the vaccine for Meningitis and they both had private health insurance. The employee then said, “Okay, that will be $120.00 from each of you.” I could tell the couple looked surprised, because of the high cost, but they had to pay anyway. They looked stressed.

Finally, we were called inside. While my friend was getting his Td vaccine, I got a bit snoopy. I wanted to learn more about the office. Maybe there were things I could learn just from looking around.

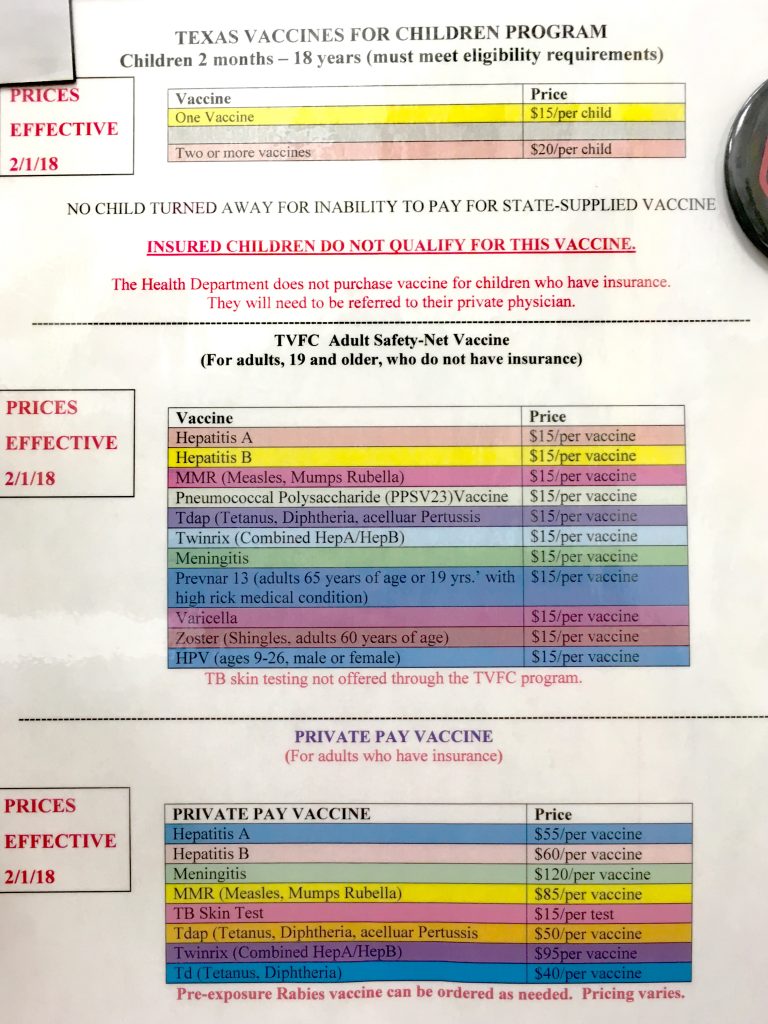

On the back wall next to the doctor’s desk was a laminated sheet of paper displaying the prices for vaccines. Here is a picture of that exact sheet:

Do you see what is wrong here? For every adult with no health insurance, every single vaccine cost $15.00. But for adults with health insurance, the vaccines cost between 166% to 700% more.

This is outrageous. The young couple in the waiting room could have saved $210.00 just by saying, “We don’t have health insurance.” They are young. The money could really help. To top it off, they have private health insurance. They pay monthly premiums, the health insurance doesn’t even cover the vaccines, and they also pay more for the vaccine itself, compared to someone without insurance.

Something is definitely wrong with the system. The community health center had the price list inside the doctor’s office, yet they didn’t hang it up in the lobby for patients to see when they walked in. I bet they do have a contract with the health insurance companies dictating how much they have to charge.

I want people to understand that while health insurance is can be a good thing, sometimes it pays to not even use it. This system is so complex though, that it’s hard to figure out when those moments should be.

I’ve read lots of stories on the Internet of people with health insurance getting charged more for surgeries and procedures than if they simply claimed uninsured and paid cash outright. Check out these articles:

How Paying Your Doctor in Cash Could Save You Money

Medical Bills Going Down If You Pay Cash – Way Down

Insured Patients Can Save Money By Pretending To Be Uninsured

The health insurance company is not on your side. They are in the business of milking as much money out of you as possible and paying out the least amount possible. Otherwise, they will go out of business.

I just wish there were more TRANSPARENCY about the prices each doctor/hospital charges for each exam/procedure with and without health insurance. Look, I went to Mexico in May. I literally shopped online for a dental cleaning the same way I shop for everything else! Why is it so difficult in the United States to find out the price?!

I don’t have the answer. I just wish the country could reach a solution that is both simple and effective.

4 Comments

This is such a great point. I have only had health insurance off and on throughout my life and have learned this same lesson from personal experience. Because insurance companies are a pain to deal with and SLOW to pay, several of my doctors offer 40% and 50% off discounts for private pay with cash or check. My general health physician, gynecologist, and dermatologist are all this way. Unfortunately this is not the case with prescriptions. Thankfully “Good Rx” helps a lot in that department.

Love your posts, Annie – keep up the good work!

Hi Jaelen,

Is there a reason why you’ve had health insurance on and off? A lot of people have health insurance from their employer, so I was wondering if the situation is the same for you. If your doctors offer 50% off discounts for cash, do you take it, even if you have insurance already? This won’t count toward meeting your deductible if you do end up having a huge procedure the same year.

And thank you for the compliment. I really appreciate your encouragement. The support makes me want to write more. 🙂

Annie

Hi Annie,

I have been on-and-off insurance but not because I’ve been in-and-out of work! So far I have yet to receive insurance from an employer because I’m still a student and have never been full-time. My dad has always had insurance from his employer but he could not always afford to have the family on his plan. My mom only had insurance through an employer once for a short time (she had employers purposefully cap her at 39.5 hours a week so they wouldn’t have to give benefits…lousy). My dad’s insurance plan right now has an insanely high deductible that has to be met by at least two people in the family before the insurance will start paying for any of us, so I do self pay for everything (in cash) because I’m reasonably healthy and I couldn’t meet the deductible in one year unless something really bad happened. I will be going full-time end of next month though, so starting next year I hope to have insurance of my own through my employer (although I am skeptical of how helpful the policy will be because of my dad’s experience). I wish things weren’t so complicated but I’m trying to make the most of it!

Cheers

Hi Jaelen,

You are still a student?? Good for you for reading about personal finance!

In my experience, what your dad went through is very common. Nowadays employers will only pay around 60% of your premium and your portion will be deducted from your paycheck. With the clients I coach, their gross income sounds like a nice amount, but after federal taxes, state taxes, and health insurance, they only bring home half of their income.

The ones that offer great health insurance benefits tend to be bad employers! At the Domino’s Pizza franchise I worked, if you worked more than 30hrs/wk, you could get a gold plan for approximately $40. But who wants to work for minimum wage? At the jewelry manufacturing factory I just quit, the employer paid for 95%, meaning you only have to pay $24 for the gold plan. I’ve never seen a place offer such great benefits, but the boss was a nut case and too difficult to work for. Even a six figure salary wouldn’t justify working for someone like him.

Let me know how it goes. I hope you get great benefits once you start working full time.

Annie